Ben Bernanke expected to taper quantitative easing program

When the housing bubble that peaked in 2006 burst as a result of thousands defauting on their subprime loans, it caused the values of securities tied to U.S. real estate pricing to plummet. The repercussions from this event caused many large banks associated with these toxic assets to fail due to insolvency and in its wake, set off a recession in the U.S. that many believe still exists to this day.

Measures made to save the U.S. from a complete economic meltdown were passed into law, beginning with the Emergency Economic Stabilization Act of 2008. This controversial law allowed the U.S. government to bail out troubled banks using hundreds of billions of dollars of taxpayer money. And according to a recent report by the U.S. Department of the Treasury, a majority of this repayment has been made.

Over the next few years, other programs initiated by the Federal Reserve to stimulate the economy followed, and one of them called quantitative easing, may be reduced as the U.S. economy begins to show signs of improvement.

Ben Bernanke, the Federal Reserve Board Chairman, is expected to announce a plan to taper its quantitative easing program at the end of its meeting this Wednesday. The $85 billion dollar a month bond purchasing program is an effort to keep market interest rates at a specified target value.

An explanation of quantitative easing, courtesy of the Khan Academy:

But many worry that this third quantitative easing effort, or 'QE3' as it's known, is still needed. And although some areas of the economy like housing are showing promise, other indicators of an improving economy such as retail sales and unemployment, it is believed, need more time to improve.

In June of this year Bernanke hinted at the idea of pumping the brakes on the stimulus program noting an improving jobs market. “In this scenario when asset purchases ultimately come to an end the unemployment rate would likely be in the vicinity of 7 percent, with solid economic growth supporting further job gains -- a substantial improvement from the 8.1 percent unemployment rate that prevailed when the committee announced this program.”

The U.S. unemployment rate trending toward 7%:

US Unemployment Rate data by YCharts

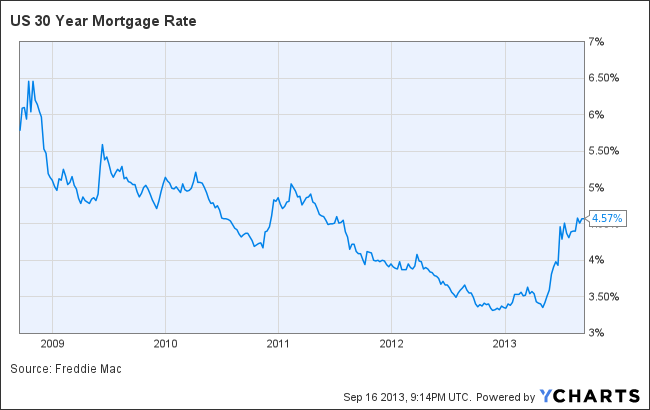

News of the taper sent mortgage rates to their highest levels in two years:

US 30 Year Mortgage Rate data by YCharts

Error

Sorry, your comment was not saved due to a technical problem. Please try again later or using a different browser.