By some estimates, hundreds of thousands of American small businesses are owned by undocumented immigrants. Tamara Jimenez and her family are one example. She and her mother came to the United States 11 years ago from Nicaragua, when Tamara was 15 years old. After years of working odd and insecure jobs, they decided to open a bakery in North Philadelphia.

“It just makes sense for our own economic security to have our own business, even though we didn’t know along the way what was going to happen to us because of the deportations,” she said one afternoon as she sold warm Colombian cheese bread. A fraction of every dollar the bakery earns is set aside for city, state and federal taxes; a Philadelphia Department of Health inspection certificate hangs prominently above the cash register. The business is legal in every way, even though all of its owners are not.

Tamara Jimenez

It’s hard to say how many companies are owned by the roughly 12 million undocumented people in the U.S. Business owners don’t need to declare their status. According to the Center for the Study of Immigrant Integration at the University of Southern California (USC), documented immigrants between the ages of 25 and 64 in the state have a self-employment rate of 13 percent (for native-born Californians it’s 12 percent). Researchers believe the rate for undocumented immigrants is lower. The late USC professor and immigration expert Harry Pachon estimated that 8 to 10 percent of undocumented people in America are legal entrepreneurs. If that’s true, it would mean this subset of immigrants owns hundreds of thousands of U.S. businesses.

Philadelphia immigration lawyer Kimberly Tomczak says it’s quite common for undocumented immigrants to own businesses in the city. “I see it a lot. A lot of my clients are business owners. It’s mostly common in restaurants or convenience stores or corner stores, but you also see it with construction and contracting work.”

Providing jobs

For an undocumented entrepreneur, becoming an American business owner can be surprisingly straightforward.

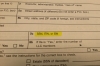

Using a birth certificate or some form of official foreign ID (passport, military or state identification), an immigrant can apply for an Individual Taxpayer Identification Number (ITIN). With the ITIN in hand, he can apply for an Employer Identification Number. Section 7b of this form asks for a Social Security number or — and this is how it’s all possible — an ITIN number. That’s it. Once he’s granted these IDs, the Internal Revenue Service considers him the owner of a legal U.S. company. Yet, because owning a business does not change immigration status, the U.S. government can still deport him at any time.

That’s what happened to Luz Jimenez, chef and owner of Los Gallos Taqueria in South Philadelphia. (He is not related to Tamara Jimenez.) In 2010 some rowdy customers attacked him. Police were called, and Jimenez ended up being arrested. Because of an agreement between local police around the country and U.S. Immigration & Customs Enforcement, he faced deportation and the possibility of losing the life he had built in America along with his business.

“When I decided to do this business, I knew the risks, I knew the problems,” Jimenez said, explaining the delicate balance that businessmen like him have to strike.

Tomczak, who is his lawyer, says the immigration judge used his discretion to put Jimenez’s case on a sort of permanent hold, in large part because he poses no threat to national security, pays taxes, runs his business by the letter of the law and also hires U.S. citizens. She brought up his restaurant as part of his legal defense.

“We used menus, we use reviews on Yelp, to show that it is a successful business. That people like it. We also show newspaper articles from local publications,” said Tomczak.

Jimenez is still cooking in Philadelphia. He now has a work permit and is confident that one day he will be able to expand his business and hire more people.

That he was allowed to stay is not unusual and didn’t surprise Nicole Scharf Kligerman, a community organizer with the New Sanctuary Movement of Philadelphia, which promotes immigrant rights. “There are so many people in Philadelphia who need jobs, and there are so many people that benefit from jobs that many undocumented business owners are able to provide,” she said.

Special challenges

Companies owned by undocumented immigrants have special challenges. Most owners tend to keep to themselves, afraid competitors may exploit their illegal status.

“It’s a challenge because you don’t know what kind of people you are going to bump into when you need help,” Tamara Jimenez said between tending to customers at the bakery, “because they may think: you don’t have a Social Security number, why do you own a business if you are not legal in this country?”

Last year she was one of nearly a half million undocumented young people granted the ability to live and work legally in the U.S. for two years under a special U.S. immigration program called Deferred Action. Since then, she has become an outspoken advocate for immigrants and teamed up with the New Sanctuary Movement of Philadelphia to protest immigrant abuse and encourage other recent arrivals to become entrepreneurs. Yet she still worries about her parents, their future in the U.S. and the business.

“If my mother gets deported, it would just crush me. I would be devastated.”

Error

Sorry, your comment was not saved due to a technical problem. Please try again later or using a different browser.